Tag Archives: Part G

Why is there a need to change a plan?

The Yr 2020, hasn’t been the optimal/optimally year round. However, to ease to the charging strain, we’ll talk on how you are able to get full policy by paying minimum quantity. Even the Medicare insurance or the Medigap present the ideal nutritional supplements what is Medicare Part G. there clearly was a great deal of buzz regarding it at the insurance industry and the reason why?

Well, It’s a very bright program. With low monthly high and premium deductible value it has got the ideal coverage in 2020.

The successor of plan F has got its own perks. This had been fast chosen since it had been to get low cost. A few have stuck with all the program F. To change it Plan G, the companies might do some instance of the day. So, in case you want to go away Plan F, just contact the agent corporation and acquire registered in Medicare part G plans.

Even the Open Enrollment Period may be your first 6 months after buying a Medicare prepare. Hereyou get to choose the health nutritional supplement plan you would like without having some queries. In case, you own a plan covering medication prescription subsequently await Annual Enrollment approach from October 15- December 7 to improve your strategy.

This really is when it is also possible to leave the physician supplemental to contact plans.

The Medical supplement program could be shifted according to the requirement and need of the buyer. In case their present plan becomes high priced or doesn’t fully cover their requirements. Subsequently it could be altered almost any moment; point. Studying the recent scenarios, it’s better to get Medicare Plan G for services that are better. You are able to alter the services everywhere and also much better health coverage for the same.

Know Why Opt for Medicare Part G

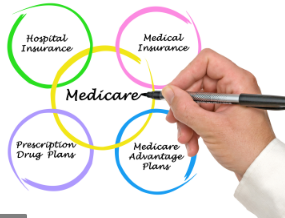

The Medicare Part G is one of the most common supplemental insurance plan for seniors above 65 years. You’ll find several explanations as to why picking Plan G is important along with Original Medicare approach.

Here really is the Insurance Policy program that offers Very best coverage with low premiums than the supplemental Strategy F program. The one difference between Plan G and strategy F would be the Strategy G will not pay the Part B lien, where as prepare F overlooks the Part B policyholder. Anyway, approach G now offers multiple saving selections for its senior citizens. There are dedicated group of specialists readily available that enables one to understand why Plan G would be the fee efficient and successful solution for you personally.

The Highlights of Medicare Supplement Plan G Protection

For any wellness remedy the Original Medicare pays first and when it’s tired, Medicare Part G measures in and pays off all the yearly deductibles foryou personally. Aspect G gives the average person with complete coverage other than the Strategy B Legislation. Below may be your prime highlights why choosing for portion G can be a viable choice.

• Coverage for basic doctor’s visits

• Part A deductibles coinsurance and hospital costs such as the hospice care copayment

• Australian travel crisis policy up to $50, 000 depending upon the policy

• Medicare Part B coinsurance surplus control and Co Payment

• Skilled nursing facility coinsurance

• Preventative maintenance section B Co Insurance

• Durable clinical equipments, lab work, blood infusions, x rays, Ambulance rides, operations and much more.

Besides Part B Deductibles, the Master Plan G Offers comprehensive coverage and paying for the deductibles of Section B isn’t a major offer for the individuals which will likely be $198 at 2020. These features ensure it is the very valued and hugely commended insurance policy after approach F supplementary software. So, get it today for added benefits.